The Rules

The rules of migration are laws. They come from the Universal Credit (Transitional Provisions) Regulations 2014

Legacy Benefits:

- Working Tax Credit – if you are in full time work

- Old-style, income-related Employment and Support Allowance – if your illness or disability causes Limited Capability for Work

- Income Support – if you are a lone parent of a child under 5, or a carer for someone with a disability, or if you have another (specified) good-reason for not job-seeking

- Old-style, income-based Jobseeker’s Allowance – if you are fit-and-well and looking for work.

- Child Tax Credit if you are responsible for a child(ren)

- Housing Benefit to help with the cost of rented accommodation.

Migration Notice

This is the letter that you (and your partner each) get from the DWP telling you that your old benefit claims will come to an end, and that you must claim Universal Credit instead.

You must be given at least three months’ notice and it is up to you to chose when (or if) to make the UC claim.

The DWP can cancel a migration notice, if it is in your interests to do so.

DWP policy says that there is no right of appeal against a decision not to cancel your notice.

Once this has been sent, the DWP calls you a notified person.

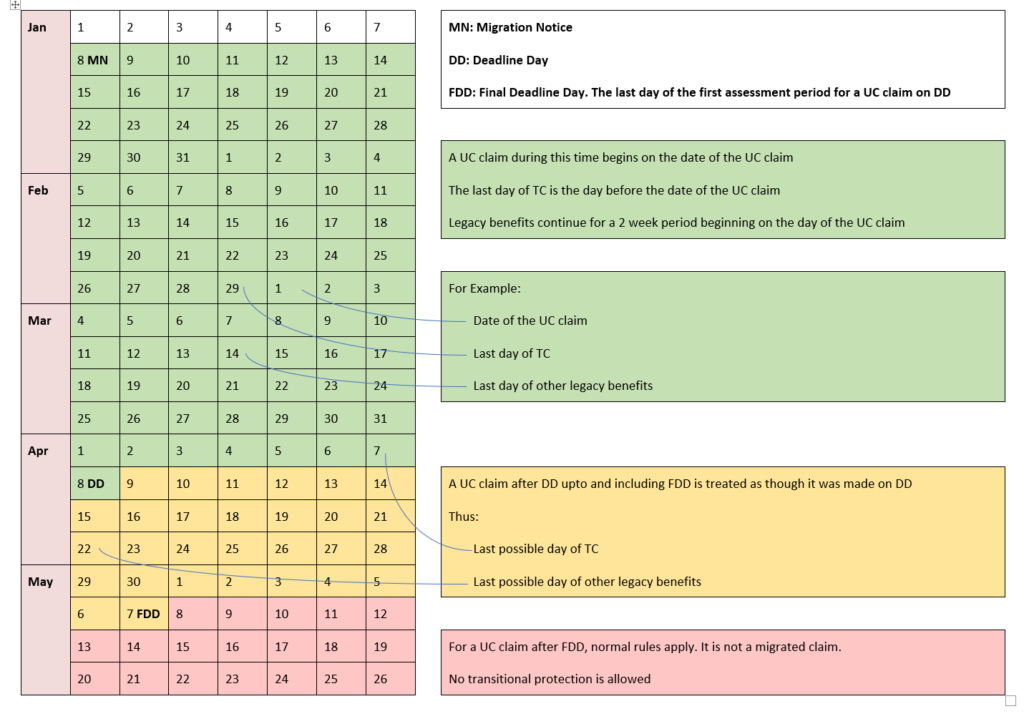

Deadline Day

This is the last day of your notice period.

The DWP can extend the deadline day, including where you ask for an extension, so long as you do this on, or before, the deadline day.

You must be notified of the new deadline day.

DWP policy says that the maximum extension is four weeks, but there is no limit on the number of times that you can ask for this.

DWP policy says that there is no right of appeal against a decision not to extend your deadline day.

Final-Deadline Day

This is the last day of what would be your first Universal Credit assessment period, if you claimed on the deadline day. So, if your deadline day was 27 June, your final deadline day will be 26 July.

You must make your claim by the final deadline day to qualify for a transitional element.

When Your Universal Credit Award Starts and Your Old Benefits Stop

If you claim on, or before, your deadline day, your Universal Credit starts from the date of your claim. Your Tax Credit stops on the day before this. Old DWP benefits and Housing Benefit run on for two weeks after the start of the Universal Credit.

If you claim after your deadline day, but before your final deadline day, your Universal Credit starts on the deadline day. Your old Tax Credit ends on the day before this. Old DWP benefit end two weeks after the deadline day.

If you claim after the final deadline day your Universal Credit starts from the date you claim, in the normal way. Your old Tax Credit ends on the day before your deadline day and old DWP benefits end two weeks after this.

If you miss the final deadline, you are not entitled to transitional protection.

If you don’t claim Universal Credit your old Tax Credit ends on the day before your deadline day and old DWP benefits end two weeks after this.

Migration Day

Your migration day is the day before your Universal Credit begins – so long as you claim by the final deadline day.

Claims

You must usually claim online at www.gov.uk/universalcredit. If you cannot manage to claim online, the helpline 0800 328 5644 may complete the claim for you.

You must usually make an appointment for your new claim interview.

If you do not attend your interview and you do not have a good reason for this, your claim will be turned down.

If you cannot attend your interview, contact the DWP as soon as possible.

You have to provide supporting evidence – such as proof of your identity or rent for the DWP to process your claim.

If you fail to provide evidence, the DWP must make a decision on whether you are entitled to benefit based on the information that they already have.

If your claim is turned down you can ask for this decision to be reconsidered, so long as you are within 13 months of the date the decision was made.

Transitional Protection

There are four main rules to help people who would otherwise get a worse deal through managed migration:

- If your standard Universal Credit level (known as your Indicative UC Amount) is less than the Total Legacy Amount of your old benefits – your Universal Credit award will include a Transitional Element to keep you frozen at your earlier level

- The Transitional Capital Disregard: Tax Credits had no savings limit, but you can only usually claim Universal Credit if your capital comes to less than £16,000. If you are a Tax Credit claimant who has more than £16,000, savings over this level will be ignored for the first 12 assessment periods after you claim UC under the managed migration scheme.

- Many people who are receiving education are excluded from receiving Universal Credit. If you are doing full-time study and getting legacy benefits, you will be allowed to claim Universal Credit while you finish your course – even if the usual rules would exclude you.

- If you are over pension age and getting Working Tax Credit, you are allowed to claim Universal Credit on managed-migration, even though you are over the usual pension-age limit

Transitional Elements = Total Legacy Amount – Indicative UC Amount

Your Total Legacy Amount is the monthly equivalent of the means-tested benefits listed at the top of this page, that you are getting on migration day.

Weekly benefits are monthly-ised by multiplying by 52 then dividing by 12.

For Tax Credits, HMRC tells the DWP the daily rate of your TC entitlement. The DWP mulitiplies this by 365 and then divides it by 12.

Your Indicative UC Amount is the amount of UC that you are entitled to, based on your circumstances on migration day.

Because of the way the rules are structured, sometimes this does not match the actual amount of UC that you get following your claim.

If your indicative UC amount is less than the actual award this will mean that you get a higher-than-expected transitional element.

If your indictive UC amount is more than the actual award this will reduce, or wipe-out, your transitional element.

More information about these problems is included below.

Transitional Elements – Example – Sophie and Lisa

All the figures used in this example have been converted from weekly to monthly amounts – even though they may be allowed or paid at other intervals.

Sophie is a lone parent. Her daughter Lisa (14) has a severe disability. They live in a council bungalow.

They get:

DLA Care Component at the middle rate of £314.82

DLA Mobility Component at the high rate of £328.25

Child Benefit of £110.93

Carer’s Allowance of £354.90

Income Support of £234.87

Child Tax Credit of £680.83

Housing Benefit of £559.00

Her Total Legacy Amount of Income Support, Child Tax Credit and Housing Benefit is £1,474.70

Her Indicative UC Amount should be £1,285.30, made up of:

For Sophie £236.86

For Lisa £489.44

For Housing £559.00

Sophie’s Transitional Element should be £1,474.70 – £1,285.30 = £189.40

Getting a Breakdown of Your Transitional Element

The DWP does not routinely explain how they have worked out the amount of your transitional element.

As with all benefit decisions, if you don’t get an explanation with the original decision notification you are legally entitled to a written statement of reasons.

Child Poverty Action Group has an online tool that will produce a note for your UC journal asking for this.

How the Transitional Elements Get Reduced – The Erosion Rules

The Transitional Element is not a permanent allowance it will be reduced as your standard rate of Universal Credit increases.

From your second assessment period onwards, your transitional element will be reduced by any new elements, or increases in elements included in your Universal Credit award so for example:

- If you are getting a transitional element when the standard rates of UC increase, the transitional element will be reduced by the same amount

- If your Housing Costs Element increases when your rent goes up, the transitional element will be reduced by the same amount

- If you have a new child, the transitional element will be reduced by the amount of any new Child Element

- If you begin to care for someone, the transitional element will be reduced by the amount of the Carer Element

Many of these increases would wipe out your transitional element completely.

According to the regulations, the only new element that does not get knocked off your transitional element is an increase in or a new award of the UC Childcare Costs Element – but see the section below about problems.

Arguably, some applications of the erosion rules will unlawfully discriminate against people with disabilities.

As migration proceeds, it is likely that there will be many appeals leading to new case-law.

Get more advice if your transitional element is eroded.

When You Lose the Transitional Element

Your transitional element stops if:

- You move in with your partner or you split up with your partner.

- You earned more than £892 (single claimants) or £1,437 (couples) in your first assessment period and now your earnings have dropped below this level for three consecutive months.

- Your UC ends for any reason and you then reclaim – unless the reason you lost your UC was because your earnings were too high and now you have restarted your claim because your earnings have dropped; and you do this within three months of the end of the assessment period in which your old claim ended.

Problem: Waiting for a PIP Claim to Be Decided

Getting an award of PIP can increase your legacy benefits; which increases your total legacy amount; which increases your transitional element.

If you get a migration notice while you are waiting for your PIP claim to be decided you can:

- Ask the DWP to cancel your migration notice; or

- Ask the DWP to defer your deadline day; or

- Go ahead with the migration, then ask the DWP to reconsider the transitional element once the PIP has been decided.

If you decide to go ahead with the migration, before you make the UC claim you should contact the DWP department that pays your legacy benefit and tell them that you have claimed PIP. You should ask them to supersede your award once the PIP comes through.

Problem: Doing Permitted Work While Claiming Legacy ESA

If you are claiming legacy ESA you are allowed to earn up to £183.50 per week / £795.17 per month with no effect on your benefits.

If you managed-migrate to UC they will ignore your earnings when working out your Indicative UC Amount, but they may count part of your earnings when they work out your actual award.

Because your indicative UC amount will be higher than your actual UC you will miss out on part of your transitional element.

Problem: Migrating While You Live In Supported Accommodation

If you live in specified accommodation your Housing Benefit does not count as part of your Total Legacy Amount.

In a recent case, a woman who lived in supported accommodation migrated to UC and qualified for a transitional element.

When she moved out of that accommodation into her own home she qualified for a new Housing Costs Element to be included in her Universal Credit award.

Her transitional element was then eroded by this amount, wiping it out completely.

The Upper Tribunal has found this to be unlawful, but new regulations will be needed to clarify how situations like this should be resolved.

Problem: Student Income, Industrial Injuries Disablement Benefit, Maternity Allowance, Tariff Income from Savings, Spousal Maintenance

If you were getting Tax Credits before migrating to UC, and at the same time you were getting one of these sources of income, you may find that DWP has now wrongly worked out your transitional element.

You should get a breakdown of your Transitional Element and confirm that this income has been taken into account in calculating the Indicative UC Amount.

If you are a student, getting student grants, loans or bursaries this can lead to difficulties in relation to your Transitional Element. Get more advice as soon as you get your migration notice.

Problem: Benefit Cap

The benefit cap limits the total amount that legacy benefit claimants can get, by reducing the Housing Benefit payment.

If you did not get Housing Benefit, maybe because you have a mortgage, or saving in excess of £16,000 you were not subject to the cap.

Now, if you managed-migrate to Universal Credit, the benefit cap can apply to your indicative UC amount (reducing your transitional element) and to your actual UC award.